MarketFlow

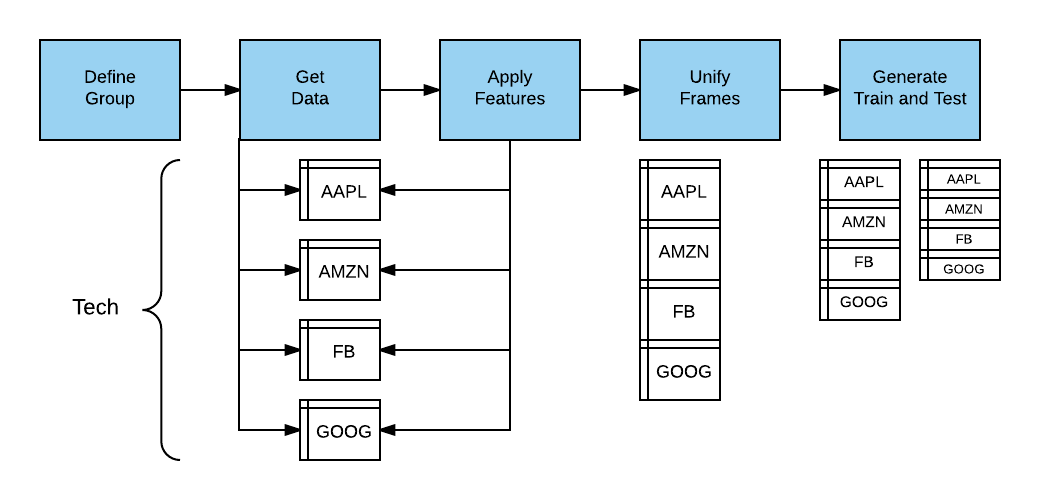

MarketFlow (mflow) is AlphaPy Pro’s specialized pipeline for financial market

analysis and algorithmic trading. It transforms raw market data into machine learning

models for market predictions, portfolio optimization, and systematic trading strategies.

Overview

MarketFlow provides a complete workflow for quantitative finance:

Data Acquisition - Fetch market data from multiple sources

Feature Engineering - Create technical indicators and market features

Signal Generation - Build predictive models for market movements

Portfolio Construction - Optimize position sizing and risk management

Backtesting - Evaluate strategy performance with realistic assumptions

Modern Data Sources

AlphaPy Pro MarketFlow supports multiple professional-grade data providers:

Primary Data Sources:

EODHD (End of Day Historical Data) - Daily and intraday market data

Yahoo Finance - Free daily stock data via yfinance

Polygon - Professional real-time and historical market data

IEX Cloud - Financial data API with extensive coverage

Legacy Support:

Google Finance - Deprecated (API discontinued in 2017)

Quandl - Limited free tier available

Note

Google Finance intraday data is no longer available. Modern applications should use EODHD or Polygon for intraday data requirements.

Data Format and Structure

MarketFlow standardizes all market data into a consistent format:

Daily Market Data (OHLCV):

Date,Open,High,Low,Close,Volume,Symbol

2024-01-02,185.64,186.89,183.86,185.64,52844800,AAPL

2024-01-03,184.97,185.89,182.73,184.25,58414800,AAPL

Intraday Market Data:

Datetime,Open,High,Low,Close,Volume,Symbol,bar_number

2024-01-02 09:30:00,185.64,185.89,185.30,185.50,125400,AAPL,1

2024-01-02 09:31:00,185.50,185.75,185.25,185.60,98300,AAPL,2

Configuration

MarketFlow uses a hierarchical configuration system combining multiple YAML files:

market.yml - Market-specific configuration:

market:

data_history : 252 # Trading days of history

forecast_period : 1 # Days to forecast

fractal : '1d' # Time frame (1d, 1h, 5m)

leaders : ['open'] # Features available at market open

predict_history : 100 # Min periods for prediction

schema : 'prices' # Data schema identifier

target_group : 'tech' # Symbol group to analyze

groups:

tech:

- AAPL

- MSFT

- GOOGL

- META

- TSLA

crypto:

- BTC-USD

- ETH-USD

- ADA-USD

etf:

- SPY

- QQQ

- IWM

Data Source Configuration:

data_sources:

primary: 'eodhd' # Primary data source

fallback: 'yahoo' # Fallback source

eodhd:

api_key: 'your_api_key'

base_url: 'https://eodhistoricaldata.com/api/'

polygon:

api_key: 'your_polygon_key'

base_url: 'https://api.polygon.io/'

Variable Definition Language (VDL)

MarketFlow includes a powerful Variable Definition Language for creating technical indicators and custom features:

Basic Technical Indicators:

variables:

# Moving averages

sma_20: 'mean(close, 20)' # Simple moving average

ema_12: 'ewm(close, 12)' # Exponential moving average

# Momentum indicators

rsi_14: 'rsi(close, 14)' # Relative Strength Index

macd: 'macd(close, 12, 26, 9)' # MACD

# Volatility indicators

bb_upper: 'bollinger_upper(close, 20, 2)' # Bollinger Bands

atr_14: 'atr(high, low, close, 14)' # Average True Range

# Volume indicators

obv: 'on_balance_volume(close, volume)' # On Balance Volume

vwap: 'volume_weighted_average_price(high, low, close, volume)'

Custom Expressions:

variables:

# Price relationships

above_sma: 'close > sma_20' # Boolean: price above SMA

price_momentum: 'close / sma_50' # Price relative to trend

# Volatility measures

daily_return: 'pct_change(close, 1)'

volatility: 'std(daily_return, 20)'

# Multi-timeframe

weekly_high: 'resample(high, "W", "max")'

Aliases for Convenience:

aliases:

cma: 'sma_close' # Closing moving average

vol: 'volume' # Volume shorthand

ret: 'pct_change(close, 1)' # Daily returns

Advanced Features

Meta-Labeling:

MarketFlow implements the Triple Barrier Method for advanced financial ML:

model:

meta_labeling:

option: True

profit_target: 0.02 # 2% profit target

stop_loss: 0.01 # 1% stop loss

max_holding: 5 # Max holding period (days)

volatility_window: 20 # Volatility calculation window

Time Series Cross-Validation:

Proper time series validation that respects temporal order:

model:

time_series:

option: True

cv_method: 'time_series_split' # Time-aware CV

test_size: 0.2 # Recent 20% for testing

gap: 1 # Gap between train/test

Portfolio Optimization:

portfolio:

optimization: 'mean_variance' # Optimization method

max_weight: 0.1 # Max position size

rebalance_freq: 'monthly' # Rebalancing frequency

transaction_cost: 0.001 # 10 bps transaction cost

Running MarketFlow

Basic Usage:

# Train models for default group

mflow

# Train with specific date range

mflow --tdate 2020-01-01 --pdate 2023-12-31

# Generate predictions only

mflow --predict

Configuration Options:

# Use different data source

mflow --source eodhd

# Extended history

mflow --history 500

# Different time frame

mflow --fractal 1h

Output Structure

MarketFlow generates comprehensive output for analysis:

runs/run_YYYYMMDD_HHMMSS/

├── config/

│ ├── market.yml

│ └── model.yml

├── data/

│ ├── features/ # Engineered features

│ ├── prices/ # Raw price data

│ └── indicators/ # Technical indicators

├── models/

│ ├── signal_model.pkl # Trained prediction model

│ └── portfolio_model.pkl # Portfolio optimization

├── predictions/

│ ├── signals.csv # Model predictions

│ └── positions.csv # Portfolio positions

└── analysis/

├── backtest_results.html # Performance report

├── factor_analysis.csv # Factor attribution

└── risk_metrics.csv # Risk analytics

Trading Systems Integration

MarketFlow can generate trading signals for various execution platforms:

Signal Generation:

systems:

long_short:

signal_long: 'prediction > 0.6' # Long threshold

signal_short: 'prediction < 0.4' # Short threshold

max_positions: 20 # Position limit

momentum:

signal_long: 'close > sma_20 and rsi_14 < 70'

signal_exit: 'close < sma_20 or rsi_14 > 80'

Risk Management:

risk:

max_portfolio_vol: 0.15 # 15% max portfolio volatility

max_individual_weight: 0.05 # 5% max individual position

stop_loss: 0.02 # 2% stop loss

profit_target: 0.04 # 4% profit target

Example Applications

1. Momentum Strategy:

target: 'future_return_5d > 0.02' # 2% return in 5 days

features:

- 'rsi_14'

- 'macd_signal'

- 'volume_ratio_20'

- 'price_momentum_50'

2. Mean Reversion:

target: 'future_return_1d'

features:

- 'zscore_close_20' # Z-score of price

- 'rsi_oversold' # RSI < 30

- 'bollinger_position' # Position in Bollinger Bands

3. Multi-Asset Strategy:

groups:

universe:

- SPY # S&P 500

- TLT # 20+ Year Treasury

- GLD # Gold

- VIX # Volatility

features:

- 'correlation_spy_20'

- 'relative_strength'

- 'regime_indicator'

Performance Analytics

MarketFlow provides comprehensive performance analysis:

Returns Analysis: * Total return and CAGR * Sharpe ratio and Sortino ratio * Maximum drawdown * Win rate and profit factor

Risk Metrics: * Value at Risk (VaR) * Conditional VaR (CVaR) * Beta and correlation analysis * Factor exposure analysis

Trading Metrics: * Transaction costs * Turnover and capacity * Implementation shortfall * Market impact analysis

Best Practices

Data Quality - Validate data sources and handle corporate actions

Feature Engineering - Focus on regime-aware features

Walk-Forward Analysis - Use time-series cross-validation

Risk Management - Implement proper position sizing

Transaction Costs - Account for realistic trading costs

Out-of-Sample Testing - Reserve recent data for final validation

For detailed examples, see the projects/ directory which includes:

Shannon’s Demon trading strategy

Time series momentum models

Triple barrier method implementations